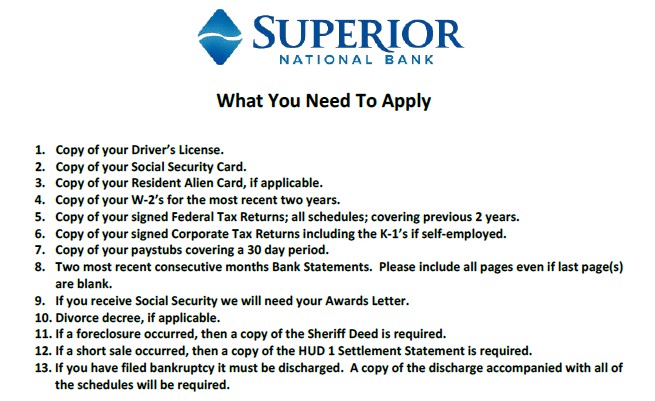

What You Need To Apply

Copy of your Driver’s License

Copy of your Social Security Card (if you are applying FHA or if you are not a US citizen)

Copy of your Resident Alien Card (if you are not a US citizen)

Copy of your W-2’s for the most recent two years

Copy of your Federal Tax Returns; all schedules; covering previous 2 years

Copy of your paystubs covering a 30 day period

Copy of your 2 Most recent Bank Statements (2 consecutive months and all pages must be included even if last page(s) is blank.

If you receive Social Security we will need your Awards Letter

Divorce decree, if applicable

If you have had a foreclosure we will need the Deed in Lieu of Foreclosure or HUD 1 Settlement Statement if property was sold as a short sale

If you have filed for bankruptcy it will need to be discharged and we will need your bankruptcy papers.

What NOT TO DO during the Application Process

Do not open new trade lines of debt. Ex. No applying for a new credit card or obtaining a new car loan/lease.

Do not decide to quit or switch jobs during the loan process

Do not co-sign for any loans

Do not make any large deposits into the bank account you are using to qualify for your mortgage

Do not let multiple companies run your credit

Do not make any late payments on your bills

Remember if you are unsure about any transaction you are about to make you can always contact your loan officer. Loan officers are always more than happy to advise you throughout your loan process.